HELOC and Family Collateral LoanWhat will they be, and which is perfect for you?

A different sort of kitchen area because of the current products might be sweet, would it? Perhaps now is the time for that building work venture you’ve been dreaming about.

Possibly she or he is getting married, and you are clearly spending money on the marriage. Or perhaps you prefer a hefty lump sum payment of cash to possess something else.

If you find yourself a citizen that has been while making home loan repayments to possess modern times, then you likely have the means to access the money to simply help pay for those biggest financial investments. The audience is these are a property guarantee line of credit (HELOC) otherwise a house collateral financing. Both are prominent options due to the fact a handy and regularly quick method to pay for highest expenses.

The fresh security of your home is the difference in the present day market price of your property and how far you owe with the the financial. Deduct how much you borrowed from on well worth and the difference can be your guarantee. Lenders allow you to borrow against which huge difference.

You might borrow against the equity of your home using your house as guarantee for cash your borrow, says Alan LaFollette, Dealing with Director to start with National Lender of Omaha.

That is what helps make HELOCs and you may household collateral money unlike good unsecured loan: Your house is the brand new collateral. And therefore the guarantee increases both because you pay down your own home loan and when new house’s really worth rises.

HELOCs and you may domestic collateral money are called second mortgage loans. But both fund are often to own smaller terms particularly, 10 or 15 years as compared to a primary mortgage, that is generally for thirty years.

A HELOC really works more like credit cards, that have a good rotating credit line, says LaFollette. Youre provided a credit line which can be found having that acquire out-of having a set period of time, that’s doing ten years. You might withdraw currency since you need it using a check or an excellent debit card attached to you to definitely account. (Note: Never assume all claims enable it to be the means to access a great debit credit to help you withdraw from a good HELOC. Consult your lender to help you conform no matter if that is permitted.)

Likewise, a property guarantee financing try a phrase loan in which you acquire a-one-big date lump sum payment. You then repay you to definitely lump sum over a beneficial pre-determined length of time at a fixed rate of interest toward same repeated monthly payments.

Acquiring an effective HELOC is a good choice whenever you are thinking about a makeover to possess an obsolete cooking area, your bathroom redesign otherwise an extension to your home. Possibly big renovations, such as for instance your bathroom redesign, may cause a rise in your house’s value.

Whether good HELOC is actually for a house update otherwise a massive knowledge inside your life particularly a married relationship or college degree costs, good HELOC or domestic security financing can still end up being the better choice for credit money. Borrowing from the bank limitations are often highest and you may interest rates are generally down in comparison to a premier-interest rate bank card.

That it utilizes several things; above all, the value of your home. Lenders generally cap extent you might obtain in the 80-85% of your collateral of your house.

Nerdwallet as well as states you generally need a credit rating of at least 620 therefore the home should be cherished from the ten-20% more your debts for the mortgage. Money and you may obligations-to-earnings ratios also are issues.

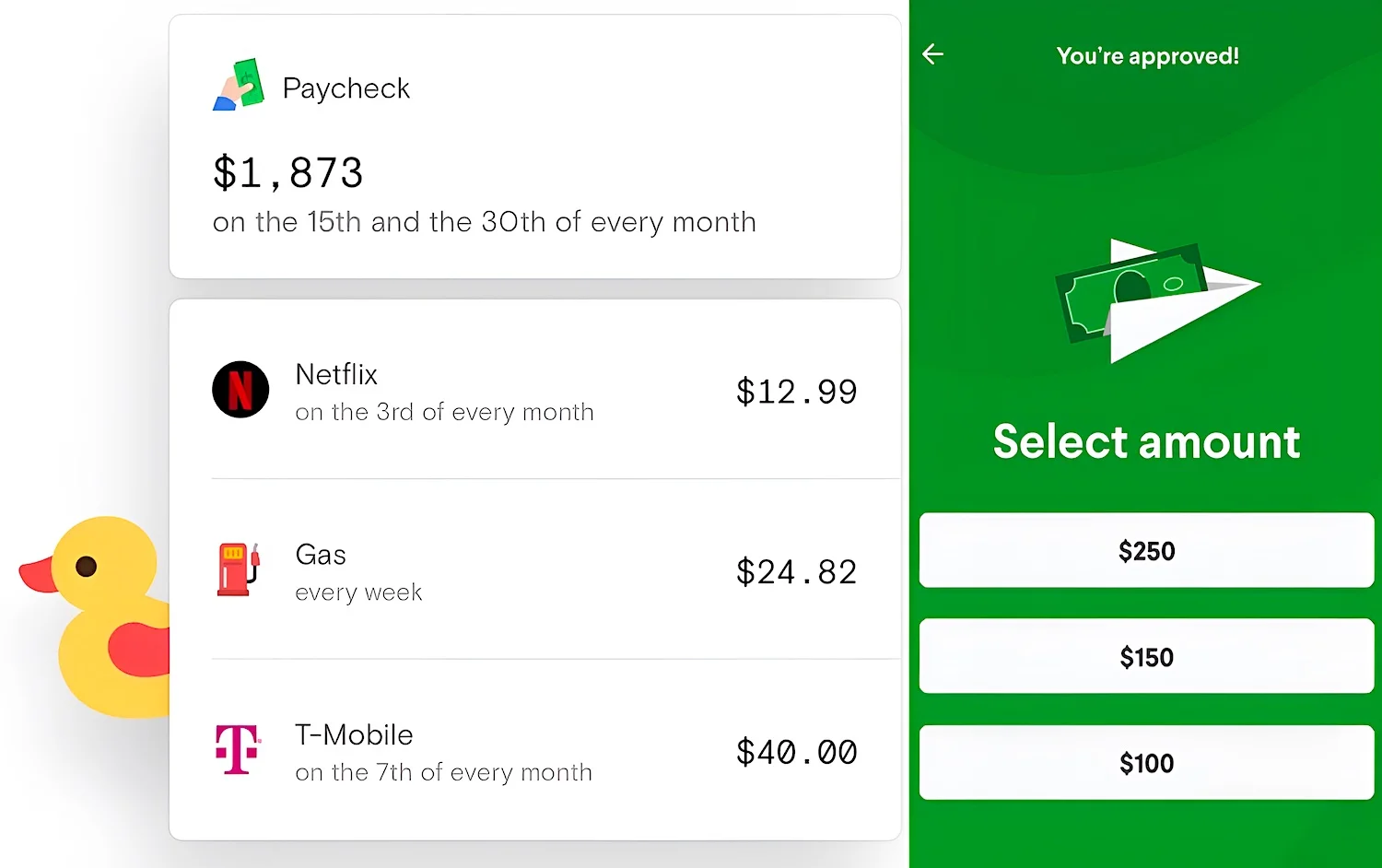

You have a property having a recent market value of $250,000 with a balance of $150,one hundred thousand towards the home loan. Your own bank enables you to accessibility to 80% of residence’s loan-to-worth security.

HELOC and you will Household Equity LoanWhat will they be, and you will which is best for your?

- $250,100000 x 80% = $two hundred,one hundred thousand

- $2 hundred,000 – $150,100000 = $50,100

- $fifty,one hundred thousand is where higher their personal line of credit could well be having good HELOC otherwise how much you can acquire to have a house equity loan.

Meaning you may make certain big renovations on your family, servers an extremely sweet relationship for your son or daughter, otherwise use that cash with other highest expenditures, eg repaying good credit debt or enabling pay to suit your kid’s degree can cost you.

If you’re you will find several positive points to taking out fully an excellent HELOC or property equity mortgage, there are also some important elements to adopt:

HELOC and Household Guarantee LoanWhat are they, and which one is the best for you?

- If you borrow money resistant to the security of your property and home values fall off one which just are able to pay it back, could result in owing over your home is worthy of. This is exactly called becoming under water together with your home loan, a challenge which had been commonplace inside houses crash of 2008, when individuals was indeed stuck when you look at the land they might not promote as their values sank installment loan Oasis.

- And don’t forget, whenever you can don’t create money on mortgage, then you chance your house starting property foreclosure since your domestic is the guarantee towards the loan.

HELOC and you will Family Collateral LoanWhat will they be, and you may which one is perfect for your?

- Do you know the rates of interest?

- If interest levels go up or down, exactly how much tend to my personal payments feel?

- How much time ‘s the title away from my personal house collateral loan?

- Just how long perform I need to repay it?

- Is actually my personal line of credit green if the mortgage expires?

In addition to talking to the lender, it makes sense to consult an income tax coach or financial coordinator exactly who might help speak about an informed options for your.