Can you use a property Security Financing to begin with a business?

For individuals who individual your house, you need a property guarantee financing otherwise family security line regarding borrowing from the bank to fund your organization, nevertheless need to put your domestic on the line.

Of several otherwise the enterprises appeared promote settlement to help you LendEDU. Such earnings is actually how we manage our very own free solution to have consumerspensation, along with instances out-of in-depth editorial research, identifies in which just how people appear on the web site.

Family equity finance and you will home security credit lines (HELOCs) let you change this new security you manufactured in your home to the bucks. Lenders usually cannot restriction the manner in which you utilize the funds from this type of funds, thus having fun with property equity mortgage first off a corporate are something that you perform.

Although not, because home equity financing try a choice for money your own business does not mean they’ve been a good choice. Domestic guarantee money are going to be high-risk while they put your home right up since the guarantee. There are many more resource choices for performing a corporate that may feel a better solutions.

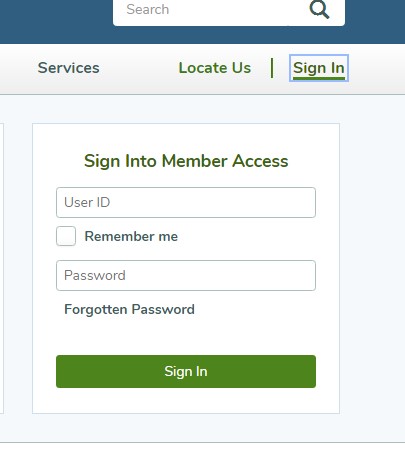

1) See if you are entitled to a house guarantee mortgage or HELOC

To begin with you have to do are make sure that you happen to be entitled to get an internet borrowing funds to own bad credit domestic guarantee mortgage otherwise HELOC.

Among the many points that lenders examine getting domestic equity funds and you will HELOCs, other than your credit score, can be your loan-to-value (LTV) ratio. This proportion measures up the dimensions of your mortgage on worth of your house. Most loan providers limit the matter might provide for your requirements so you can ninety% 95% LTV.

Such, for those who own a house well worth $five hundred,000 and you can work at a loan provider that have a max LTV off 90%, you can’t get that loan who push your house-related debt previous $450,000 (90% of one’s house’s worthy of). If for example the financial equilibrium was $350,000, meaning their restriction loan are $100,000.

You can use the house security finance calculator to obtain your newest LTV and just how much you’re permitted acquire.

2) Determine whether using home collateral first off a corporate ‘s the proper flow

It’s also advisable to be at liberty to look at if or not utilizing your household equity is the greatest solution to finance your online business. Home collateral fund and HELOCs make use of household while the security, placing it at risk. If you cannot afford the financing, the financial institution you’ll foreclose on your house.

When you use personal loans, you aren’t placing your house americash loans Lake View within head risk. You should be positive about your organization and take good high likelihood of making use of your family collateral to invest in your online business.

3) Go with a house equity loan against. a beneficial HELOC

Family collateral funds give you a lump sum payment of cash you to you can use since you need. The interest rate to possess a home equity loan is oftentimes fixed, and that means you can be expect your own monthly payment over the lifetime of your own mortgage. They have been good for large, one-date expenses.

HELOCs turn your property with the something similar to credit cards, providing the possibility to draw in the guarantee on the house as frequently as you need so you’re able to within the HELOC’s mark months. HELOC rates constantly start lower than house security financing rates, but they are variable, so that the price you are going to increase over the years.

HELOCs is actually suitable for firms that get small, lingering expenses that you should shelter. A family one regularly has to purchase new directory can benefit from using an effective HELOC more than a home collateral financing.

4) Come across a loan provider to work well with

With any type of financing, selecting the right financial is essential. Which is exactly the same if you find yourself searching for a property guarantee mortgage otherwise HELOC. Making the effort to shop around will save you a great deal of cash.

Perhaps one of the most considerations examine ranging from lenders is actually the pace that each bank offers. The reduced the rate, the greater once the straight down prices decrease your monthly obligations and mean it is possible to spend quicker towards financing overall.

One more thing to evaluate is the closing cost of the mortgage. Extremely home collateral fund and HELOCs keeps initial charges. Coping with a lender which have straight down if any charges can save you plenty of cash.

Don’t forget to discuss with the lending company that you use to own their mortgage otherwise bank account. Of many provide commitment bonuses that will make their offers so much more aggressive. Our courses to your better home guarantee fund and best HELOCs helps you start off finding the right bank.

5) Make use of your fund and start fees

After you’ve acquired the loan otherwise HELOC, you happen to be happy to use the finance and begin paying off the debt. Keep in mind that household collateral fund have a lump sum payment, whenever you are HELOCs enable you to generate multiple pulls on the home’s collateral as soon as you have to do thus.

New payment from household collateral funds and you will HELOCs are slightly various other. With domestic collateral finance, repayment usually starts instantly. You can start getting monthly payments while having to send a fees each month.

With a HELOC, you merely need to make money by using new HELOC so you’re able to borrow funds, much like credit cards. From inside the mark several months, you can acquire on HELOC, pay-off the bill, and you can obtain once more as often as you need to help you, up to your borrowing limit.

Following the mark months concludes, usually regarding 10 years, you are able to begin getting a monthly bill to the HELOC balance. Possible normally have to expend the balance off over the second ten to fifteen ages.

Home collateral money versus. small company money

If you’re not certain that using your household security is the best way to fund your business, you should take time to believe other available choices. Of a lot lenders bring specifically made home business financing to help people get the new organizations off the ground.