- By the pause on student-loan repayments, I spared a fortune to have a deposit.

- The good news is that they’re creating again, I could not save yourself getting a home.

- I need to make lots of tough s on the hold.

For a long time, my $35,000 debt strung more than my personal direct. Each and every time I bought an item I desired, I pondered whether I ought to rescue that cash for my payments. When i moved renting from inside the New york, We worried I would getting rejected on account of my personal personal debt.

However, you to definitely changed if the federal government paused financing repayments and you will decrease the interest prices to help you 0% in the middle of the fresh pandemic. We decided I am able to breathe.

Over the past 36 months, I happened to be in a position to in the end lay my places into upcoming. Nevertheless now that payment stop is coming so you can a finish, I payday loan in Plainfield Village need to lay my arrangements into the hold and you may greet back my financial stress.

I became like most higher-university elderly people: excited to view an educated school I could and start living since the an adult. I recall some individuals advising us to consider condition colleges, but We decided I experienced to go to a great esteemed personal school so you’re able to impress folk.

We wasn’t thinking about my personal coming notice and also the personal debt I carry out face shortly after graduation. One to coming notice felt like a fantasy; We did not envision myself due to the fact a grown up-right up expenses expenses, just what exactly did it amount basically went to a college I did not manage?

We subscribed to Emerson University while the a journalism big. On account of my personal family’s finances, We obtained gives that purchased the majority of my personal university fees. I was still left having a substantial expenses through to graduation.

After school, We paid back my personal month-to-month minimal and you will thought grateful in the event the costs were paused

Whenever i finished within the 2015 and you may got my very first complete-day work, I became and come up with no more than $55,000 a year. Living in New york city, I was capable pay rent and you can eat out several of that time weekly.

Then again my scholar-loan-payment elegance several months found a conclusion, and i was required to initiate paying down my personal $35,000 personal debt. I panicked. Thank goodness, We wasn’t making that much money, so i was required to pay only on the $100 1 month because the I happened to be toward an income-driven bundle.

When the 2020 stop started, I was in the end in a position to relax. With this costs on the back burner, I am able to contemplate my personal funds in different ways.

We reach create a smooth lifestyle and you may plan for my coming

Over the past three years, I’ve obtained multiple introduces. Since i didn’t have any figuratively speaking to repay, We become saving – much.

I always wanted getting a flat someplace in Florida and you may checklist they toward Airbnb. It decided the best money opportunity, in addition to enterprising element happy me.

I knew I needed at the very least $31,000 to pay for a down payment. Since i worried about rescuing and had the additional currency in the place of my loan money, I have been able to get personal. I was in a position to place my finances behind an aspiration I try thinking about.

Also, in the 2022, Chairman Joe Biden established his plan for student-mortgage forgiveness. Less than one package, an astonishing $20,000 of my personal loans would’ve already been destroyed. With far faster financial obligation, I realized it might be more straightforward to rating a home loan, and i you will set my coupons on my personal Airbnb package.

My personal scholar-loan costs are beginning again, plus they are triple the cost

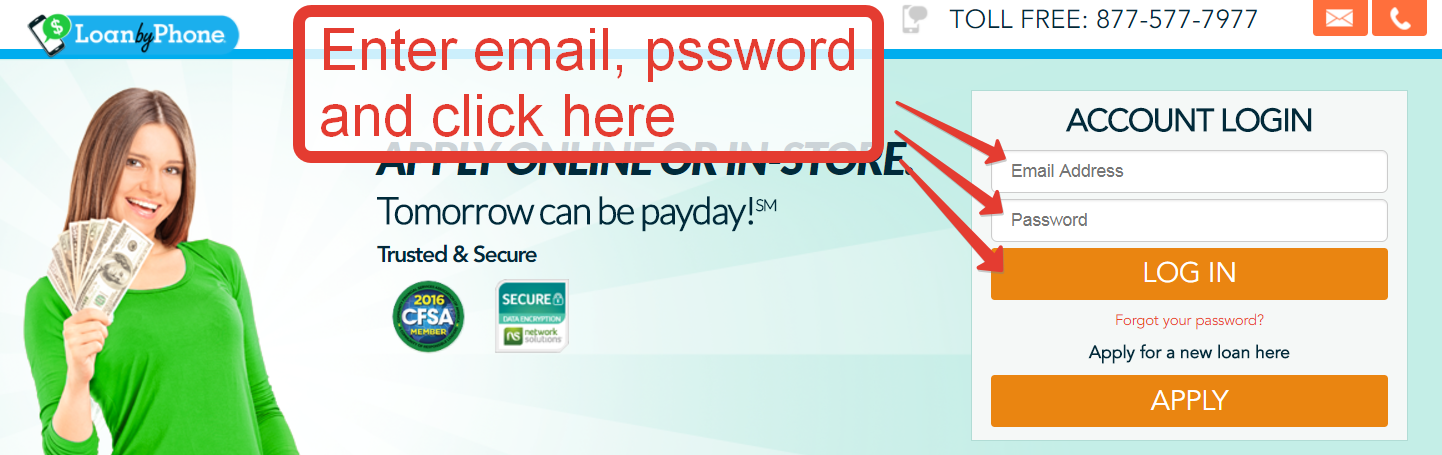

A week ago, We logged towards the and you may put on the fresh new Conserve system, hoping to get the newest $100 monthly premiums I found myself paying till the pandemic. That has been a fool’s fantasy.

Since i now make more money than just I found myself till the pandemic, my personal money jumped so you can $350 1 month. While i saw the quantity, I happened to be amazed. The fresh new common stress crept into.

I wondered: Exactly how will i afford you to definitely? As to why didn’t We spend less particularly for my money into the pause? As to why did I go to an exclusive college or university in the first put?

I am now compelled to put my personal ambitions on the keep to blow back my personal finance

After my stress subsided, I got to locate actual having myself. We survive a rigorous budget. All cent Really don’t invest in necessities has gone with the my deals regarding domestic. Given that additional money is certainly going with the my personal $350 money.

Meaning Im preserving virtually no money getting my personal future; hence, I won’t reach the $29,000 objective Now i need to own a down-payment.

I debated using all money We secured along the prior long time to pay off my figuratively speaking and performing once more to operate to your a deposit. But in all honesty, that plan depresses me too far. I additionally argued leaving the position I adore much just to locate paid down more. I have also considered delivering the next employment.

I don’t have any responses yet ,, however the terrifying the reality is I’ll must put my goals to the hold.