Purchasing your first residence is a complex techniques ( listed here is helpful tips which could make it easier to ). A big part of it are selecting the right home loan. Its a financial commitment that will eat up a serious bit of your income and could perception your for a long time, making it vital which you make the best decision. The information below helps you decide which home loan(s) is generally best for you.

Virtual assistant Finance

These are mortgages provided by conventional loan providers which can be backed by new You.S. Agency from Veterans Circumstances. They are limited to help you army https://availableloan.net/installment-loans-la/spokane players, veterans, as well as their household. There are some advantages in addition to well low interest rates, minimal settlement costs, zero advance payment, as well as zero financial insurance coverage payments.

USDA Funds

If you are looking buying a property in the a rural area (outside the Dual Places) you must know home financing throughout the U.S. Agencies off Farming . You must meet the money conditions (earning below 115% of one’s average money towards urban area). These mortgages none of them an advance payment and gives well low interest rates.

HUD Rehab Funds

If you’re considering to shop for property which can need some functions, a rehab financing backed by the You.S. Agencies regarding Casing and you can Urban Development (HUD) can help you. You might sign up for what exactly is entitled a good 203(k) mortgage. This choice enables you to obtain adequate currency to help you each other buy a property and work out requisite repairs in order to it. Given that regulators helps guarantee this type of loan, you must proceed through a national Homes Administration (FHA) accepted bank to help you be eligible for and discover a beneficial 203(k) loan.

FHA Finance

Brand new FHA helps other loan applications around the nation to own very first-date buyers which have straight down revenues. The fresh new finance provides low-down payment criteria (only 3.5% of house’s rates), lower closing costs, and you may a basic credit approval processes. You actually have to work alongside a lender that’s accepted of the FHA .

Start out of Minnesota Homes

Minnesota’s State Homes Money Department even offers downpayment and settlement costs money in order to income-certified borrowers. The applying is called Start up and qualified borrowers can access doing $17,000 within the service. These types of loans haven’t any notice and are usually not necessary to be repaid before the first-mortgage on your own house is repaid. These finance are going to be with other basic-big date homebuyer software.

Personal Loan providers

Particular banking institutions and other loan providers (as well as personal counties and urban centers within the Minnesota) provide unique mortgage loans having earliest-date homeowners. Yet not, the facts (interest rate, words, accessibility, an such like.) change regularly. Brand new Minnesota Homeownership Center’s web page towards business couples hyperlinks so you’re able to a great list of the present day products.

TruePath Financial

- A 30-seasons term which have reasonable repaired mortgage

- Repayments put from the 31% of borrower’s earnings

- No deposit demands

- Downpayment advice when needed to make the pick reasonable

- No home loan insurance rates

- Settlement costs direction plus financial help full

This new TruePath Home loan exists due to TCHFH Lending, Inc., an entirely-owned subsidiary away from Twin Places Habitat getting Mankind. Funds is employed to get belongings about 7-condition location section of Minneapolis and you will St. Paul. A beneficial TruePath Mortgage can be used to get a property founded by the Twin Metropolises Environment otherwise a house which is available on open-market.

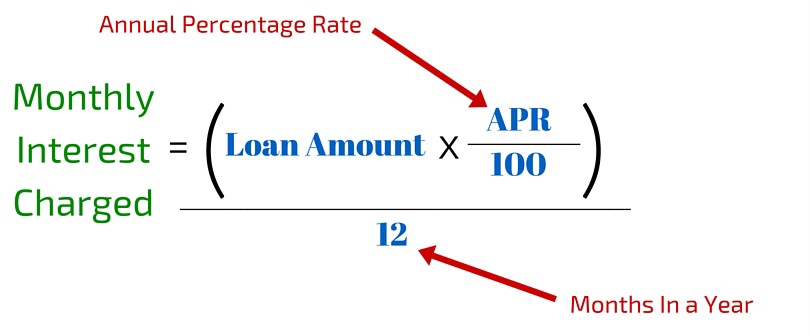

Is actually The Mortgage Calculator

- This calculator will not determine your own actual financial count.

- It doesn’t verify Dual Metropolitan areas Habitat is also contribute the full guidance amount noted.

- To help you be eligible for a great TruePath Mortgage, you need to fulfill all of the money or any other underwriting conditions.

- Even though your own affordability means you can afford a lot more, a purchase having a TruePath Financial will be simply for all of our restriction loan amount.

There is lots to look at when searching for very first home. With many mortgage selection, this may feel just like a frightening task. Glance at Dual Towns Habitat’s Basic-Date Homebuyer Guide – it is a great starting point to help make the techniques simpler, one step simultaneously.