All the fresh homeowner or long-time citizen would like to tailor the room. It could be a kitchen area remodel, a cozy restroom repair, otherwise a bigger house addition opportunity.

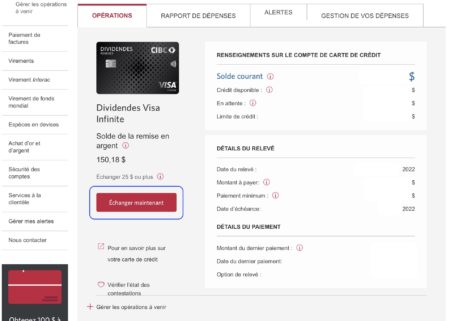

Before dive with the contractor prices and plans, think tips loans a house introduction for the Virginia. Investment a home inclusion into the Annandale, Va, relates to choices off personal and home security fund to help you authorities apps. Each resource approach possess advantages of more economic facts and you may possessions brands.

- Resource property improvement requires cautious considered and you may budgeting.

- Get quotes regarding additional loan providers before you choose a loan for your advancements.

- If you are not offered financing, government software are methods to invest in a home inclusion.

Family Introduction Investment Choice

A study implies that residents enjoys spent additional time and cash home based improvements once the 2019. New expanding cost of a residential property probably has an effect on the new rise from inside the house introduction ideas. In reality, really property owners have picked out so you’re able to change in the place of purchase another possessions.

Financial support App Techniques Tips

When considered property addition with resource in mind, it is best to remain one another your general finances and you may possible financing selection. Here you will find the suggestions to properly apply for a home improvement financing during the Virginia.

1. Influence Their Capital Need

In advance of addressing lenders, estimate the quantity needed for your property addition during the Annandale, Virtual assistant. Here are the key considerations:

- Credit score: Home owners is always to verify he’s an enthusiastic A credit history. Its described as no late money over the past year and you may no maxed-aside credit cards.

- Loan-to-Worth Proportion (LTV). Loan providers gauge the loan-to-value proportion, that ought to perhaps not go beyond 80% of one’s house’s appraised really worth.

- Money Factors: Their full monthly obligations need certainly to are nevertheless less than thirty-six% of the gross month-to-month income. In addition to house commission by yourself didn’t go beyond 28%.

Obviously pinpointing the recovery requires is even very important. Should it be an expansion away from living space or upgrading fixtures, with an obvious objective assists estimate will set you back.

dos. Select the right Financial

For domestic collateral items, start with your bank otherwise borrowing from the bank union. To have refinances otherwise FHA 203(k) mortgages, a mortgage broker you are going to render a whole lot more certified recommendations.

Take a look at some loan providers examine interest rates, costs, and you will financing terminology. This is very important to be certain you have made the best price offered.

step 3. Select Competitive Prices

Usually do not be happy with the first offerparing prices regarding numerous loan providers can also be possibly save an amount of attract along the lifetime of the borrowed funds.

4. Assemble Needed Files

Shortly after producing your write-ups, you need to get pre-accredited. That it preliminary action provides you with an idea of just what amount borrowed and you can terminology, if annual otherwise payment, you would expect regarding lenders.

5. Complete The loan Application

Fill out the borrowed funds software very carefully and fill out it including most of the requisite paperwork. Make sure you learn all of the regards to the loan, for instance the Annual percentage rate and other will cost you. Think of, you really have an effective about three-go out window on closure day to help you terminate when needed.

On top of that, choose the right builder to ensure your home inclusion project is actually successful. Elite group Designers Services is actually registered, covered, and you will noted for their profile. I besides guarantee quality works but may additionally be a importance of particular financing approvals.

Conclusions

For every approach has benefits and drawbacks, of leverage the fresh new guarantee New Jersey title and loan in your home that have a HELOC otherwise family collateral mortgage in order to examining consumer loan government programs. Making sure you decide on the best money experience important for a profitable do it yourself endeavor.

Of these inside Annandale, Va, trying to start a property inclusion endeavor, tapping into info like Elite Designers Properties is most beneficial. The gurus bring detail by detail understanding to the venture execution to be certain their house addition is prosperous.