Influence. Assets permits much better leverage than other expenditures. Such as, if you have $100,000 when you look at the deals, you could potentially invest it in a collection regarding offers, otherwise put it to use buying a house worth $five hundred,000 by taking aside a home loan for $eight hundred,000. When the offers rise because of the ten% within the season, their show profile might possibly be well worth $110,000 while will have gained $ten,000. If the assets increases because of the 10% throughout that exact same seasons, your house might possibly be worth navigate here $550,000 and you could have gathered $fifty,000.

You do not have a big salary to pay. When you are to get to invest, lenders takes rental money as well as your very own earnings in their review. For many who currently individual your house while having some equity inside, you may be able to use which given that in initial deposit, meaning that you should buy a residential property without having to discover any additional bucks. Or even own your house and you can getting you may want to not be able to afford you to definitely, to get a residential property is generally an excellent means so you can one-day having the ability to manage your home.

The amount of money should i use?

All of us are unique with regards to all of our money and you may borrowing from the bank demands. Or contact us today, we are able to help with computations centered on your needs.

How to find the mortgage that is true in my situation?

Our very own books to mortgage products and features will help you to discover regarding the chief solutions. You will find numerous additional mortgage brokers available, therefore communicate with you now.

How much cash create I need having in initial deposit?

Always anywhere between 5% 10% of your property value property. Consult with me to mention your options getting in initial deposit. You’re able to borrow against the brand new security on the current family or money spent.

Just how much commonly regular money become?

See our very own Repayment Calculator having an estimate. Because there are a wide variety of financing items, certain that have straight down introductory costs, correspond with all of us now in regards to the marketing currently available, and we will find the appropriate mortgage lay-right up for your requirements.

How many times manage I build mortgage repayments – weekly, fortnightly, or monthly?

Really lenders promote flexible installment options to suit your pay duration. For folks who choose a week or fortnightly costs, in place of month-to-month, you will make alot more repayments inside the a-year, that may probably shave cash and you may time off the loan.

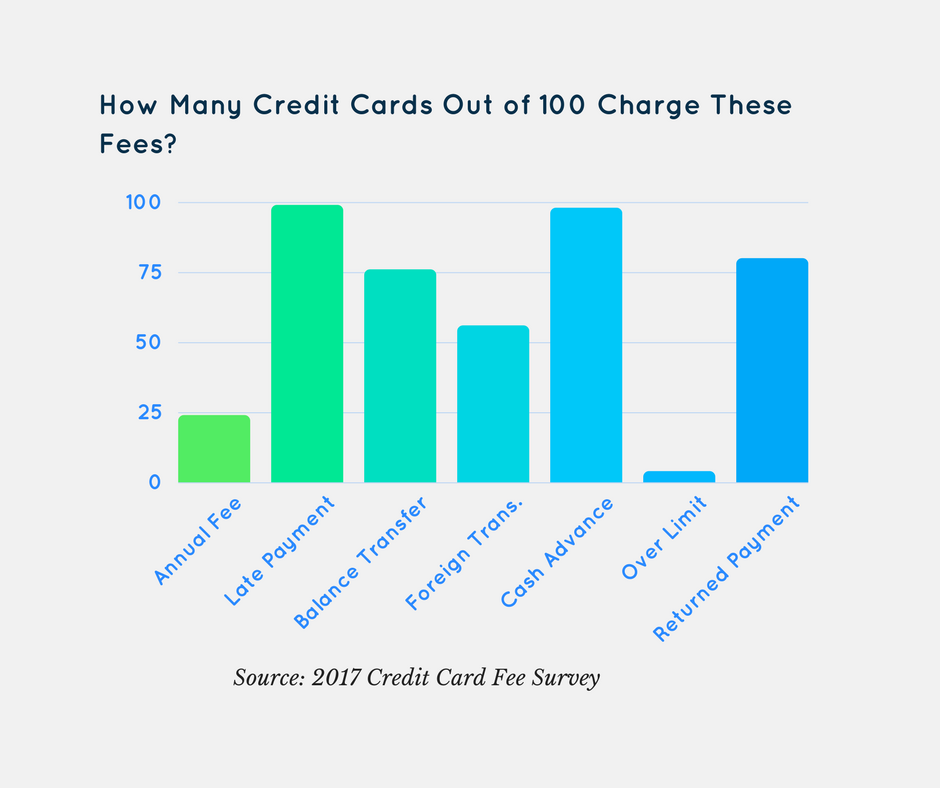

Exactly what costs/will set you back can i budget for?

There are certain charge inside when buying property. To get rid of one surprises, record lower than outlines every typical will set you back:

- Stamp Obligations – This is the large one to. Some other prices are relatively short in comparison. Stamp obligations prices are different ranging from state and region governments and now have depend on the worth of the property you buy. You p responsibility into the home loan alone. To find out your own full Stamp Obligation charge, visit our very own Stamp Responsibility Calculator.

- Legal/conveyancing charge – Generally doing $step one,000 $1500, these types of costs coverage all of the courtroom rigour to your residence buy, also name online searches.

- Building examination – This should be done-by an experienced specialist, such as for example a structural engineer prior to buying the home. Your own Price out-of Product sales will be subject to the building inspection, so if discover one architectural problems there is the alternative in order to withdraw throughout the get without the high economic punishment. A creating examination and you can report can cost up to $step 1,000, according to sized the house. Their conveyancer will usually arrange this review, and you can usually pay it off as part of the complete invoice on payment (as well as the conveyancing costs).