If you are obtaining home financing then the chances are high the lending company need to see your lender comments, but what makes this type of associated?

To possess operating individuals the lending company carry out be prepared to discover an income borrowing from the bank entry to your employer’s label stated. This may following feel mix-referenced with other documents they could consult to help with your home loan application for example payslips and you may P60s. To have worry about-operating individuals the lending company is searching for normal loans hence recommend affordability of your home loan is actually alternative.

The bank report will even let you know when you find yourself researching lease off one functions you assist. If you are using an administration company the reduced net’ leasing figure would be found (we.elizabeth. when they has actually deducted its costs), which are often this new shape the lending company will use to determine whether or not the house is care about-financing.

The lender will go from the directory of deals and look closely for any bounced head debits or condition instructions. Earnings from inside the (opening equilibrium) compared to the expense (closure balance) to see if you live within your setting and are generally on the position to look at the additional commitment off a good home loan.

The financial institution may also examine if for example the societal lives, take a trip otherwise holidaying try a lot more than mediocre and whether or not you’ve got a keen excessive playing habit.

Really loan providers will still provide for people who enter into an agreed’ overdraft facility provided it is confirmed (extremely lender statements indicate this new overdraft number to them otherwise a letter from the lender do serve). Loan providers will get better understanding should this be a seasonal enjoy eg Christmas time and you will will be reduced knowledgeable when it an effective recurring function as it gives the impression you are living past their setting. Staying in an enthusiastic overdraft may also have a direct impact on your credit (computerised section system built to rates your chances of paying borrowing from the bank) and therefore depending on the bank can result in their financial software being refuted.

There are some loan providers which do not have good borrowing scoring’ plan preferring to allow an underwriter decide and have several lenders who would entertain you surpassing the latest overdraft limitation. When you yourself have got knowledgeable such problems a professional large financial company such as Niche Advice should be able to guide you further.

The lender use the lending company comments observe new magnitude of your own obligations (such as signature loans, hire purchase, secured finance, credit cards, bank cards etc) and you can measure the payment conduct. It is common having candidates to understate the loans updates on the home financing application form simply to be found aside when the bank comments was basically provided. Non-revelation try frowned upon, and certainly will lead to the financial software getting rejected, so it’s thus essential that your financial statements was checked carefully and credit responsibilities reflected securely regarding form.

What exactly do lenders look out for in the bank comments?

College loans, maintenance repayments, childcare, knowledge fees, societal memberships, lease, insurances, pension contributions, property provider charges can all be placed exposed and you may taken into account by financial within affordability comparison.

If there is a massive put on your account (circa ?step 1,000 or higher), and this is obviously not related into occupations, then your bank is likely to people to possess a description. Why? Well he’s got a duty from care and attention towards Money Laundering Regulations and as such need to be the cause of this new origination out-of The put continues regularly purchase the assets. A comparable tips manage utilize it there several shorter undeterminable credits.

The financial institution will generally find bills, riding licences as well as the latest voters roll to proof in which you real time, however, the bank declaration provide a separate way to obtain verification supply all of them extra comfort.

This could be an area of paperwork that can produce rage. Lenders’ have become fussy to your style of one’s financial statements.

The newest dated fashioned’ paper comments are usually liked by loan providers as they can certainly give whether or not they are definitely the genuine blog post. Candidates could possibly get not surprisingly provides a resistance so you can spend the completely new data but the financial can go back this type of given that mortgage processes might have been complete.

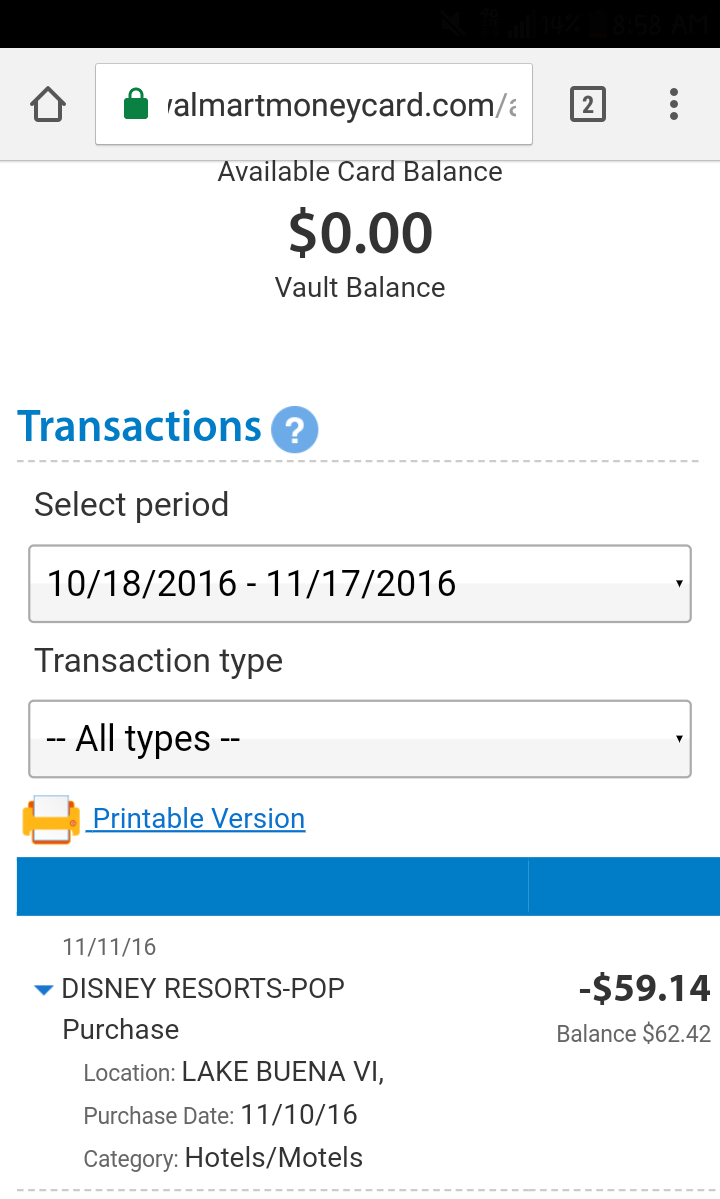

A number of the Lenders are obviously banking institutions by themselves and you can enjoy you to definitely moments features managed to move on to an on-line paperless industry, and as such they will accept comments produced right from the bank’s webpages considering he is from inside the a recommended style. Here you will find the secret format guidance on the comments less than: