Too often, our Colorado home loan forbearance lawyer party fields phone calls away from property owners that are eager to stop foreclosures as they waited long to do something to your an overdue financial equilibrium. It is primarily for this reason why proactively taking new words away from a good forbearance plan are going to be way more beneficial to a great homeowner’s borrowing from the bank than unsafe.

Fundamentally, if the good homeowner’s house is foreclosed upon, their borrowing might possibly be briefly decimated. By contrast, recognizing the newest regards to an excellent forbearance can lead to a fairly minor drop in a great homeowner’s score.

This is not to declare that getting a forbearance is the greatest way forward for all citizen who’s struggling. If your monetary issues is really gonna take care of regarding the forseeable future, this approach is a wonderful way to avoid the possibility of property foreclosure while maintaining a relatively solid credit rating. That being said, in case the battles will take time to answer, declaring bankruptcy could be an excellent solution.

Although this financial obligation government choice might briefly spoil their borrowing get, its a strategy seen by loan providers as a whole lot more in control than simply incurring a foreclosures. And you will, if the filing for Part thirteen relief makes it possible to rearrange the debt and you can keep your domestic in one go, the temporary borrowing-relevant effects may be valued at the troubles.

Reconstructing The Borrowing Just after a beneficial Forbearance

If the getting good forbearance is an excellent selection for your however, you continue to be worried about the way it will change the stamina from your credit rating, know that you’ll reconstruct the rating notably more than a short period of energy. This new devoted Texas home mortgage forbearance lawyer people on Leinart Legislation Agency are prepared to discuss down borrowing reconstructing tips to you any moment. Before this, listed below are some old choices to believe:

- Spend the money you owe on time, everytime

- Broaden the kinds of personal debt your debt

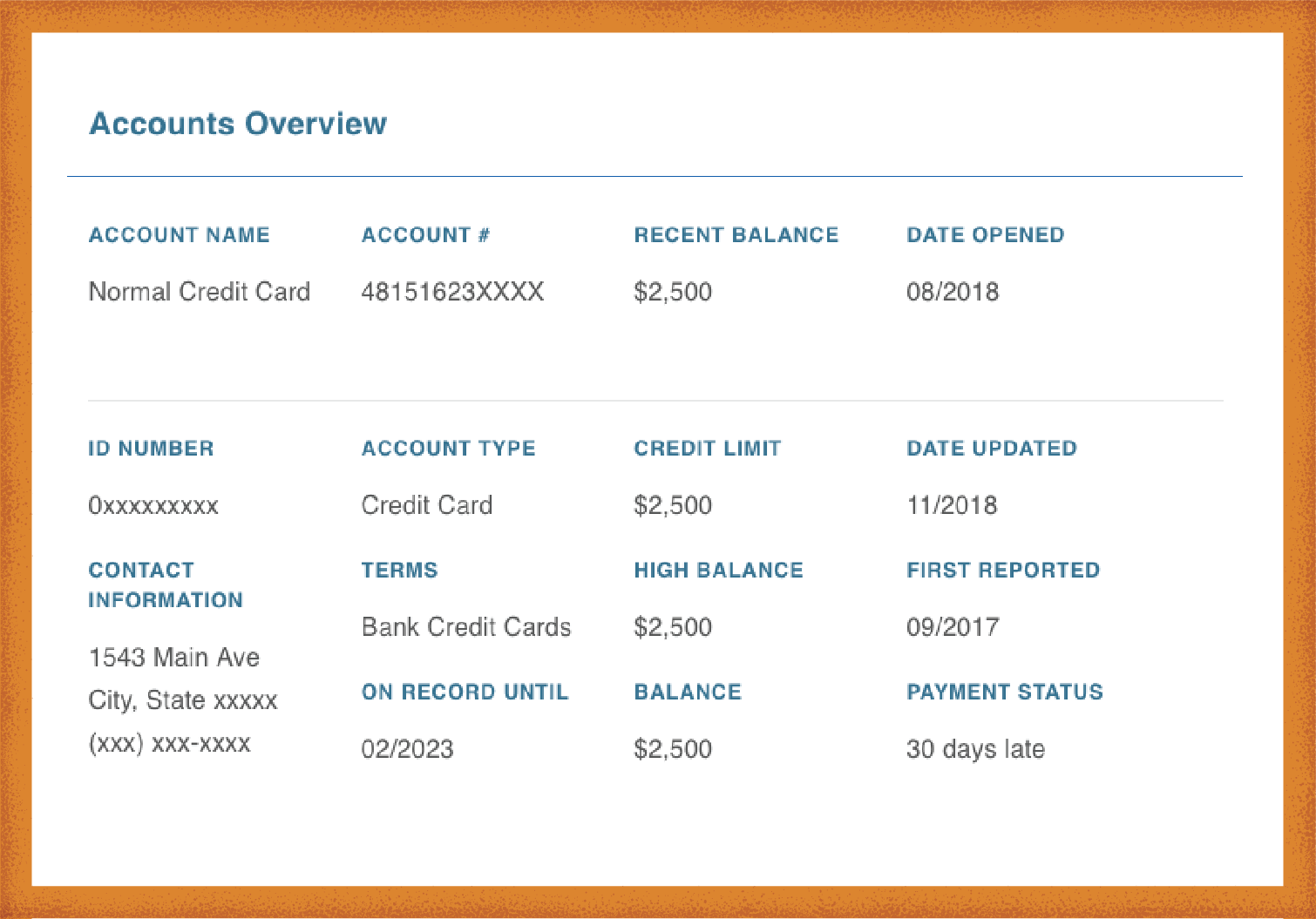

- Display screen your credit history and request repairs to any incorrect information

- Keep borrowing from the bank balances apparently reduced

- Think enjoyable an effective co-signer that has higher borrowing from the bank the next time need financial support

Mortgage Forbearance Lawyer Faqs

Choosing while you are entitled to mortgage forbearance requires conversing with your financial otherwise Tx real estate loan forbearance attorneys. Whenever conversing with their bank or financial provider, we want to inform you proof financial hardship. An attorney makes it possible to collect suggestions that shows one to economic burdens you cared for, leading you to follow financial forbearance. In addition must conform to all the requirements establish by the the lender’s forbearance stipulationsplying loans Onycha AL with this conditions shall be difficult to browse, but a legal professional will know tips assist you with clinging these types of criteria.

Which are the Main reasons why Someone Search Real estate loan Forbearance?

By 2023, the new U.S. remains technically throughout the COVID-19 pandemic, some aspects of neighborhood possess returned to typical, particularly people totally operating. not, of many property owners, teams, and companies are nonetheless experiencing the blowback from the pandemic. Many people missing their efforts because of the pandemic and you can sometimes have acquired problem resuming work or had their circumstances otherwise spend cut. Most other things about looking to home loan laon forbearance may include:

- Disasters

- Losing a career due to non-pandemic causes

- Property taxes increasing

- Natural disasters

Can i Need to pay Additional Interest For Financial Forbearance?

Fundamentally, consumers don’t have to spend more desire on the mortgage loans during loan forbearance. Usually, the mortgage attention remains the same, nevertheless the speed changes in case your bank or carrier develops the loan rate of interest or offers the borrowed funds readiness time. When utilizing a tx mortgage forbearance attorneys, it’s important to inquire about issues such as for example: