Function Home loan Classification could have been branded one of the recommended home loan loan providers inside Baltimore Maryland since we try provide a number of a minimal rates and you will fees on the wholesale field. You will find a simultaneous from financing choices out-of good Virtual assistant financing, FHA loan, Jumbo financing, USDA mortgage and practical Refinance mortgages.

Interests on the our very own work and you will carrying it out right is exactly what Ability Mortgage Classification concerns. Its towards customers in addition to their assumption of us and you may its overall experience in united states that renders you a chief. We appreciate your organization and check forward to development consumers having life!

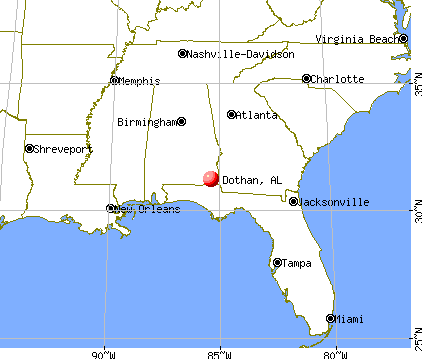

Baltimore MD Mortgage lender

Transparency out-of surgery was a highly important aspect out-of a great lending company within the Baltimore. Try not to favor a home loan company who is not clear adequate and you can cannot keep you advised each step of ways. Low-quality mortgage brokers will cost you large appeal simply to reach their month-to-month income address. So complete visibility is what Ability Mortgage Class is focused on.

Our company is A Audience: History however at least; we have been mortgage team one listens to you. I make sure to protect the passions. Within Function Mortgage Group, you are the priority hence we definitely focus on your financial budget and requires.

Refinancing mortgage within the Baltimore Maryland

Substitution your existing mortgage with a brand new towards various other terms and conditions is labeled as home loan refinance. How come their financial know that you be considered? This is accomplished because of the calculating your loan-to-worthy of ratio of the splitting the bill due in your financial and you may virtually any debts protected by the property on latest value in your home. Youre permitted to re-finance in case the financing-to-really worth proportion is actually lower than 80%. Their month-to-month earnings and you can debt costs also are checked because of the bank. Copies from data files you might be questioned to add become; the home loan statement, notice out-of evaluation or a recently available pay stub, past year’s taxation statements, recent advantage statements to suit your financial investments and you may savings accounts; and a current property tax bill.

Va financing in Baltimore Maryland

The reason for a beneficial Va Loan would be to offer lasting financial support so you’re able to Experts in all divisions of military. Obama administration-formal loan providers can material V.A loans, on promise of the U.S Veterans Government. Remember that instant same day payday loans online Alaska Virtual assistant Finance require no deposit and you may are very more straightforward to qualify for than simply conventional loans.

We will cheerfully help you determine whether you are qualified. Generally, a great number regarding latest and you may former servicemen meet the requirements. For example:

- Reservists

- National Shield members

- Certified enduring partners

- Active and you will retired military members

- Veterans

FHA financing in the Baltimore Maryland

An enthusiastic FHA covered mortgage was an effective All of us Federal Houses Government mortgage insurance coverage served home mortgage awarded because of the a keen FHA-accepted lender. They might be essentially a form of government assistance. Over the years, these finance have let straight down-earnings People in america in order to borrow cash to order a house you to less than normal activities might have been too costly in their eyes. FHA loans can handle new house customers instead of real home traders. Like that, they differ from normal financing for the reason that the house need to be occupied by owner for at least a-year. Generally, funds with lower down-money involve more exposure toward lender. Hence, the house buyer must pay a two-area home loan insurance policies; a one-big date bulk fee and you may a month-to-month instalment to help you mitigate the danger

USDA loan when you look at the Baltimore Maryland

One or two form of USDA Mortgage apps exist: Protected and you will Direct for each and every with various legislation and you may requirements. The latest USDA Secured Financing has no a limit. While doing so, the USDA Lead Financing has a-flat restrict.