With regards to capital significant costs or combining loans, a couple of well-known choices are home security financing and personal loans. One another version of finance also have money you want, but understanding its differences is crucial to creating a knowledgeable decision. Before making a decision and this loan product is right for you, you will need to glance at key distinguishing items such as the you want getting collateral, borrowing amounts, installment terminology, interest rates and you may credit score requirements.

If you find yourself a home collateral and you will a personal bank loan one another offer availableness so you can fund, he or she is two somewhat various other lending options.

Secured vs. signature loans

Household collateral funds was secured loans, definition he is supported by collateral. In this instance this new security is your family. Secured personal loans was directly linked with particular property, making certain the lending company can get well its financial support if you standard for the financing.

Personal loans are generally unsecured, meaning they will not require any guarantee. This is why he is open to a wide a number of borrowers. But not, it means unsecured loan rates of interest is greater than domestic guarantee finance since the lack of security setting the lender are bringing a larger chance.

Credit quantity

Household equity fund allows you to control the new collateral amassed into the your home for borrowing from the bank aim. New guarantee you have is the appraised property value your residence without people a fantastic home loan balance. A home collateral loan fundamentally makes you obtain a maximum regarding 85% of the collateral in your home.

At exactly the same time, certain issues influence this new borrowing from the bank count for personal loans, like your earnings and you can credit score, the intention of the mortgage, the newest lender’s regulations, etcetera. The most you can acquire which have a consumer loan are essentially $100,000. It’s a good idea to understand more about certain loan providers and you can make use of a consumer loan calculator to find the terms and conditions one to be perfect for debt requires.

Cost terms

Domestic security money commonly incorporate offered cost terminology, typically 5 in order to thirty years. This enables individuals in order to pass on the latest cost more than a long period. Personal loans often have smaller repayment terminology, generally anywhere between that seven many years, which function high monthly obligations.

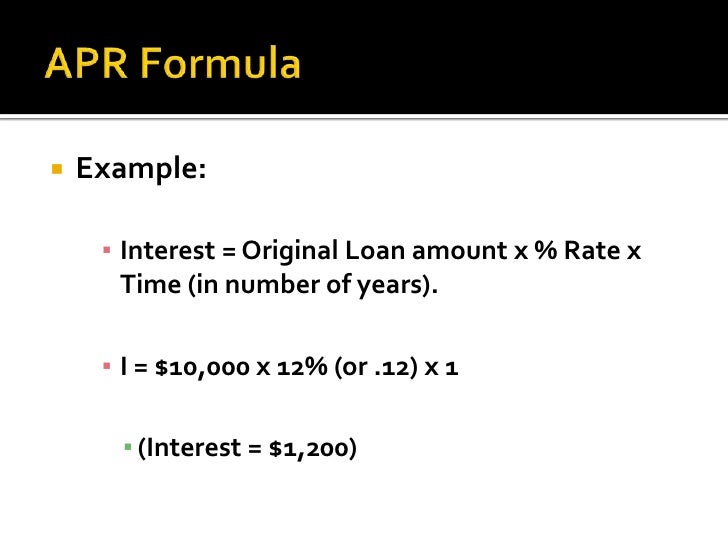

Mediocre interest rates

Domestic equity funds are apt to have straight down rates than just short unsecured loans because of the security involved. An educated household collateral mortgage prices are often fixed, delivering balance on loan title.

Unsecured loan cost, getting unsecured, are generally higher because there isn’t any guarantee to decrease new lender’s chance. Most unsecured loans include repaired prices anywhere between 6% and you may thirty-six%.

Credit rating criteria

Even when household collateral fund try shielded of the equity, it nonetheless normally have significantly more strict credit rating criteria since they encompass huge borrowing from the bank quantity. Loan providers often choose consumers with good to expert credit ratings.

Personal loans may be even more open to consumers with just fair so you’re able to good credit. Lenders bring signature loans to a greater variety of borrowing from the bank pages but rates of interest and terms and conditions will vary according to creditworthiness. When you yourself have a decreased credit history, you can find signature loans to own poor credit available from particular lenders. See our very own selections to find the best poor credit money.

Getting accepted to have a consumer loan

Boosting your credit score is the best solution to improve chances of taking a personal bank loan. You are permitted to demand a copy of credit file of each one of the major credit reporting agencies (Equifax, Experian and you may TransUnion) annually. Feedback they and you will report people errors otherwise discrepancies on the borrowing agency and collector. As much as possible rating completely wrong negative guidance got rid of, your credit score will most likely improve.