Advantage verification, if you are maybe not loaded with possessions, is an intrusive processes. When you yourself have ample form, with many hundred or so thousand bucks left after your downpayment, you will not obtain the same inquisition peak just like the other consumers. The original-time customer, having scarcely adequate currency for a long visit to IKEA immediately after it romantic, can get a very authoritative inquiry than simply their future-more successful-selves should expect.

In the event that every person dislikes resource verification, given that conditioned because they are extremely towards the document-controlled load of getting a mortgage, it should be crappy. So why could it possibly be complete? Since the loan providers must ensure you have enough money to fund your own advance payment along with your settlement costs.

Individuals are anyone, and their financial decisions shows one to. Anybody sporadically overdraw. Someone both do not know where one $287 dollars deposit came from, exactly. Sometimes they know exactly where that $287 cash put originated from but favor that the bank maybe not know-no matter if not knowing means its mortgage acceptance might be at risk.

Do not blame the loan officer, that is merely pursuing the recommendations when they’ve to ensure the property. The most basic path, towards the least number of soreness, should be to follow. Here are the habits you really need to end and really should embrace so you can result in the process simpler and you can price the application coming so you can acceptance.

Trick Takeaways

- Loan providers need certainly to be sure their property getting home financing to make certain which you have money to expend your own downpayment and you will one necessary reserves.

- Money is difficult to shade and could perhaps not amount because an enthusiastic investment in the event the the provider can’t be verified.

- Prices for nonsufficient funds and you can overdraft fees try red flags in order to lenders.

- Of a lot finance allow gift finance, nevertheless they must also end up being affirmed.

What’s Felt a valuable asset?

Assets are people financing or investments which you have offered for your requirements. They were the online really worth. They may be of some of the after the present:

- Checking profile

- Coupons profile

- Cds

- Money industry levels

- Old age profile

- Brokerage accounts

The latest Danger of money

Lenders find out if all the possessions your number in your loan application try affirmed and you can securely acquired. They do this of the evaluating the 2 newest comments having people account listed on the application. Whenever reviewing the brand new comments, every put-no matter what quick-should be confirmed regarding its origin.

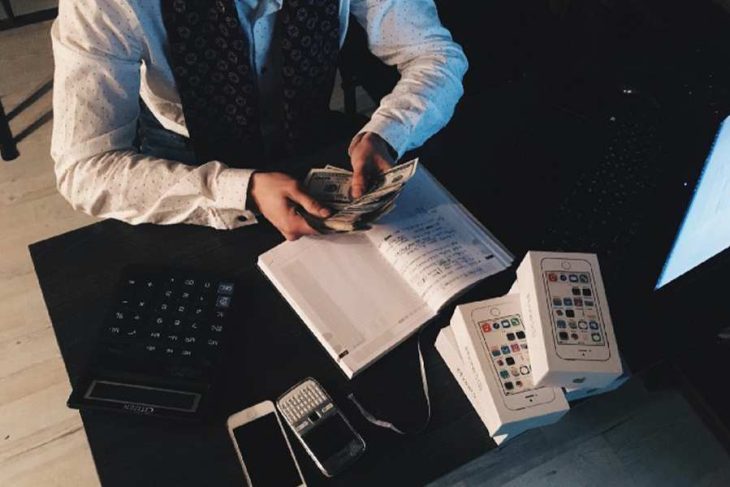

Loan providers never work on untraceable funds from a borrower. Very often implies that bucks deposits to your a merchant account can’t be put. Places of money may actually taint the entire membership to ensure that none of the cash in that membership are used for the purchase of the property.

In the event your behavior would be to cash your income, pay your bills towards cash, and you will put this new leftover money toward financial, avoid nowadays. Deposit the check into the financial, or take aside only just what dollars need which means you haven’t any dollars dumps starting your money.

Dings because of the Nonsufficient Financing

A loan provider examining their lender statements can be reject the borrowed funds if the there are prices for nonsufficient money (NSF) otherwise overdrafts to cover Automatic teller machine distributions otherwise inspections your authored on the brand new membership. A lender will not give your money for many who have numerous NSF costs or overdraft costs on your account. Should you have several instance which is often explained inside a letter, that will be excusable, but a period of these directs up warning flag. So remain a cushion on the account, and get on top of your balance.

Complications with Gift suggestions

You can make use of a profit provide away from a close relative, employer, or personal individual pal to help with a downpayment or closing costs, but only when the person giving the provide can prove that the money was in a bank account ahead of bestowing it on you. Such as your own assets, merchandise have to be verified and you will of a let origin. It is better when your donor’s bank report will not include high payday loans New Canaan no job dumps instantly before the day of your detachment; when it really does, those individuals dumps in addition to have to be acquired, and/or current may not be desired.

As well as a lender declaration regarding the donor appearing new money to give, try to provide research that present was given, such as for example a copy of your see, and you must provide evidence the fresh current could have been deposited on your account. Always, a bank report exhibiting the newest put have a tendency to serve.