A home loan app may be an extremely disheartening task, particularly through the a worldwide pandemic. Yet ,, you retain questioning when it is well worth delaying including a serious circulate.

For many of us, mortgage loans are only a fact away from existence. But, COVID-19 or perhaps not, we have no options however, to save conquering up against the newest.

Inevitably, the initial point you must grapple with will probably be your credit score. When you need to qualify for home financing, you have to see the absolute minimum credit rating requirements. But mortgage loans are not precisely tericans will most likely do not know what type of credit rating might you would like and/or myriad from home loan choices they may be able favor. This information dreams so you can connection one to pit.

Today, let’s set those people fears out and put our very own thought limits to your. It is time to learn the vital information to know that usually provide mortgage-able this 2021.

(Note: This informative article is the FICO Rating design since which is the quintessential popular system from the credit agencies.)

Security

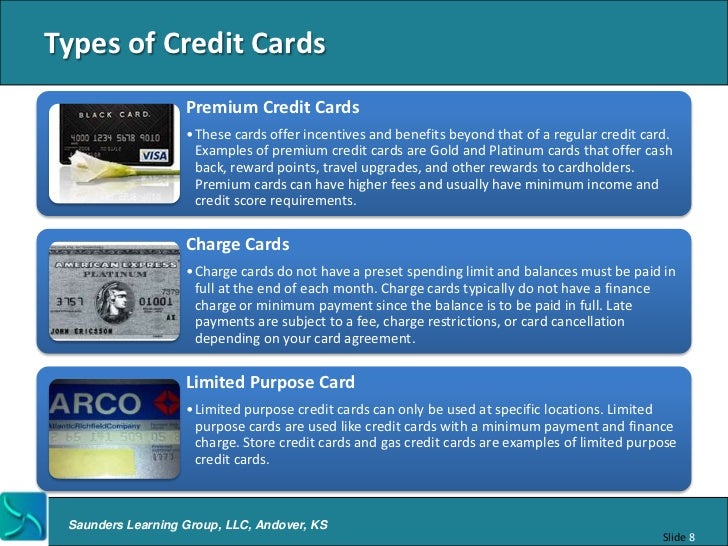

A home loan try a guaranteed form of loan. By safeguarded, this is why for folks who end paying off your loan, the financial institution gets anything you have reciprocally. In this case, you clean out ownership of your property, together with home loan company offers it to recuperate its loss.

Cost

Amortization is additionally something tends to make mortgage loans more complicated for all those. You never pay off the loan financial having a one-big date payment. As an alternative, you will be making an initial fee complete with put and you can closing costs, and then you rating charged having fees every month. However you try not to just split your full mortgage because of the count out of months you only pay. Interest levels alter, and regularly, mortgage insurance is as well as with it. In the place of almost every other finance, mortgage loans handle an incredible amount of money repaid more good longer several months.

The way amortization work, it may be tough to imagine how much cash your property tend to ultimately costs once you’ve generated the final payment in your loan. This is why its critical to select the right loan terms and conditions proper off the bat, end paying for insurance rates, and make the largest deposit that offers usually enable it to be.

What is during the a credit score?

Due to the fact credit ratings try exhibited once the several, it may be scary to determine that which we features if i’ve no basis for testing. Its particularly learning the scratching in school. Credit scores commonly precisely anything we include in our very own public media users often.

FICO Score

For FICO, ratings start at the three hundred, towards high one being 850. But, however, one may get zero credit rating at all. Up to 45 billion People in the us may well not need a credit score today. It means that there is no need enough credit history yet out of promoting a get.

Always, it takes at least several borrowing accounts with no less than half dozen months of pastime to locate a very perfect picture. Your credit score usually incorporate all the research amassed from the moment you open the first borrowing from the bank account towards last percentage reported from the a lender. Making it you’ll be able to to find varying ratings out-of additional bureaus within various other periods.

Multiple facts sign up for all of our FICO Score. Master of these circumstances are all of our fee history. However, it is vital to know that desire are heaviest into investigation recorded for previous period. Hence, if you’ve generated a later part of the fee ahead of however it has been long enough on present, Taylor loans it really will most likely not connect with your own get up to a great later commission you have made using your newest billing stage.