Sale/Leaseback. Evaluate whether condition guidelines exclude identity lenders pragmatic site regarding structuring money because whether your debtor “sold” their cellular where you can find the lending company immediately after which “leased” it right back. Particular loan providers make use of this tactic so you can evade price caps or commission limitations.

Repossession Conditions and Straight to Get rid of. Comprehend the conditions on your state’s label loan laws one to associate towards the repossession of the cellular house for the default. At the same time, look out for one liberties and you will protections agreed to borrowers inside the instance their home are repossessed in advance of offered to repay new loan.

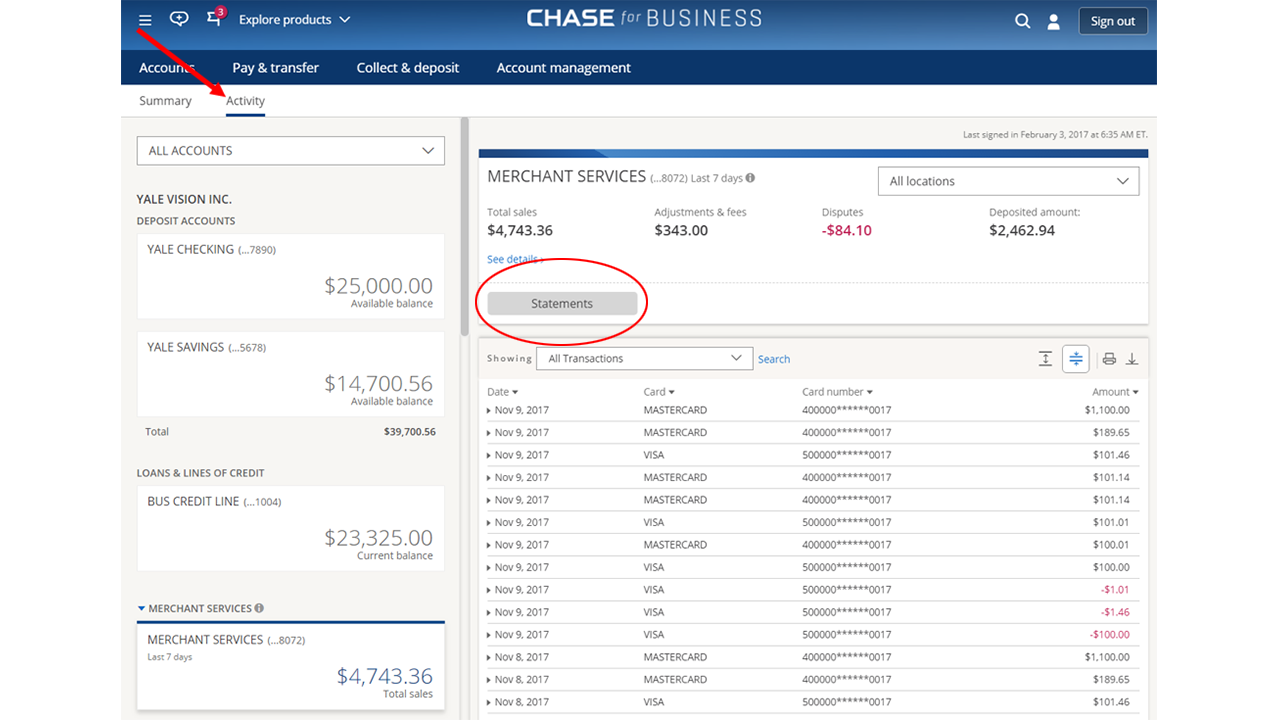

Pay On the internet. Very lenders offer an on-line site or system that allows borrowers to join while making costs digitally thanks to its term mortgage membership. This procedure provides a handy means to fix manage your money away from the comfort of your device.

Pay Over the phone. Another option is always to create costs over the phone having fun with a great credit otherwise debit card. Of numerous lenders promote a phone payment option, making it very easy to manage costs without needing on line access.

Family savings Repayments. Some loan providers ensure it is borrowers to prepare you to-big date payments or recurring payments right from the bank account. So it automatic commission strategy can help be sure on the-day payments, since fund are deducted as scheduled.

Money Transfer Towns. Specific lenders will get take on repayments made within playing currency import towns and cities. You can query with your financial to choose whether or not it payment system is available in your neighborhood.

See otherwise Currency Acquisition. If you want conventional commission methods, you can post a check or money buy toward percentage control center given of the lender. Definitely tend to be the loan account details to make certain best crediting of fee.

Choice

Pawn Store Financing. For many who own specific precious jewelry, you can consider good pawn shop loan. This type of fund use your stuff due to the fact collateral.

Less than perfect credit unsecured loans can handle those with poor otherwise restricted borrowing records. These types of financing normally have large rates of interest, but they also provide entry to financing when traditional loan providers will get refuse your application. Specific on line loan providers focusing on bad credit financing include Upstart and you will OppLoans.

Repayment funds resemble unsecured loans however they are generally speaking paid during the repaired monthly obligations. They can be accessible to borrowers that have numerous credit scores. OneMain Financial and Avant are types of loan providers giving payment funds.

Pay check Solution Loans try small-dollars fund particular borrowing from the bank unions give as an option to old-fashioned cash advance. They arrive that have all the way down rates and borrower-friendly conditions. Some borrowing from the bank unions offer Company. Like, the fresh Navy Federal Borrowing from the bank Connection now offers Company in order to the members.

Editorial thoughts

Mobile home term finance is actually a financial product that, like many financing solutions, have various has actually and you may considerations. On one hand, these financing render a handy supply of fast access to help you loans, an element that may be like very theraputic for people making reference to unanticipated financial issues. The absence of credit history examination can be advantageous, because lets individuals that have differing borrowing from the bank experiences so you’re able to safer money when needed, filling a space you to definitely conventional financing have a tendency to not be able to target.

Still, it is important so you’re able to means cellular home title funds with a balanced perspective that takes under consideration the possibility cons. New main concern is the risk of repossession, as defaulting toward payments may result in the increased loss of brand new borrower’s top home. At exactly the same time, the latest possibly higher-rates of interest with the this type of fund you certainly will fill the general costs of borrowing from the bank, which can twist challenges for the majority people. If you are these money may serve as a financial lifeline, consideration and you can a comprehensive understanding of the particular terminology, and adherence to state guidelines, are very important and come up with told choices.