Home owners have the ability to tap their collateral with the next home loan for renovations, obligations shell out-of & cash-out. Submit an application for an additional mortgage and watch which kind of security financing otherwise HELOC is best for your circumstances.

Which are the Second Mortgage Criteria?

Consumers want to know to find another financial. This really is simple, find aggressive brokers otherwise loan providers and satisfy their 2nd mortgage conditions. That means you will want to go after the underwriting assistance, such lowest credit score, restriction personal debt to help you money proportion and be below the limitation loan in order to well worth ratio.

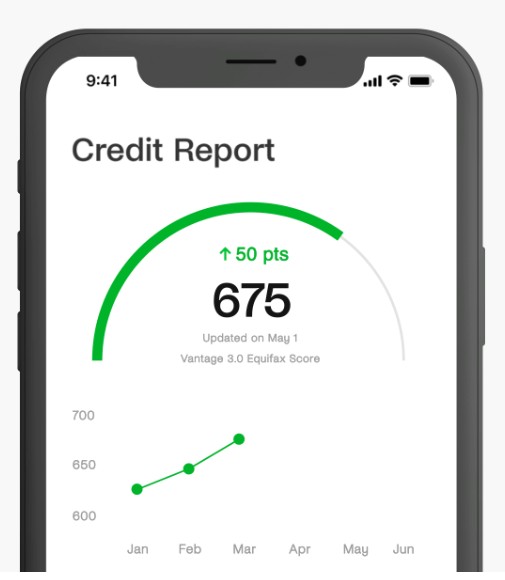

Very, credit history, DTI and you may LTV would be the three riding points to fulfill really traditional 2nd financial recommendations. Remember that 2nd home loan standards can transform any kind of time some time and brand new RefiGuide helps you stay state-of-the-art on rules free of charge.

For those who have low credit scores or a reputation later costs, conference what’s needed to have an extra home loan out-of conventional banking institutions and you will borrowing from the bank unions would be problematic. If you’re secured loans normally have a lot more easy qualification conditions than just unsecured choices, loan providers generally wanted a credit rating from 620 or maybe more.

- Verification employment

- Proof of earnings (W2’s, 1099’s, newest pay-stubs)

- Household Valuation (assessment to decide Mortgage so you can Worth)

- Fico scores (Between 580 680, according to guarantee)

- Debt-to-Earnings Proportion (DTI below forty-five%)

- Copy of financial notice

- Declaration page away from Homeowners insurance Coverage

- Duplicate out of Month-to-month Mortgage Statement

These types of activities may also dictate your interest and overall 2nd home mortgage approval. The greater your credit rating in addition to decrease your loan to value are, the low the risk your pose in order to loan providers, resulting in most useful also provides.

Most first-mortgage bucks-away re-finance programs enable consumers to access as much as 80% of their residence’s well worth. Next mortgage loans, at exactly the same time, may extend so you can 100% of the residence’s really worth, while most keeps an upper restriction regarding 85%. Typically, 2nd mortgage loans enable you to acquire as much as 80% to help you 85% of your residence’s appraised well worth, deducting your own an excellent mortgage harmony.

Less than perfect credit next financial software generally speaking cover anywhere between 70 and you may 80% combined financing to help you value (CLTV) Particular Oklahoma payday loans loan providers can offer large loan-to-value rates, with a few even allowing up to 100% borrowing from the bank into the specific cases. Very few lenders offers a second financial with less than perfect credit when your borrower has less than 20% guarantee in their home.

So what can Make use of another Home loan to have?

You’ve got the independence to make use of the cash out of a 2nd-mortgage the function of their opting for. Generally speaking, leverage household equity is better to have significant renovations or endeavors one enhance your financial situation, like financial obligation fees. It’s not generally speaking suitable for short-term expenses such as for instance escape shopping or getaways or betting.

- Do it yourself Strategies

Can one minute Financial Negatively Impression Your Borrowing from the bank?

Obtaining an additional home loan to repay pre-present costs could potentially possess an adverse affect the credit rating. This might end up in stretched commitments to help you multiple lenders. not, and also make your second mortgage payment promptly every month tend to raise your credit score. While you are refinancing credit card desire together with your next mortgage that will together with help increase your credit scores.

The point that of one’s count is the fact the next mortgage commonly not hurt your credit. In many cases, taking out fully property collateral financing up against your property increase your own credit ratings if you make your monthly premiums punctually. In most instances, customers get bad credit ratings since they’re late for over 30-days to their monthly obligations.