Divorce proceedings are tiring or painful in many ways, and you will determining how to fork out your residence equity toward mate doesn’t create people easier.

Your have in all probability a home loan price on dos-3% range for many who purchased or refinanced before early 2022. You won’t want to promote our home, spend charge, then pick again within eight% or even more.

What is in this post?

When you split up, the brand new court you can expect to let you know that this new companion is entitled to 50% of your present equity throughout the home.

Including, for those who have a home worth $five hundred,000 and you may a great $200,000 mortgage harmony, our home provides $three hundred,000 in security.

The judge might say for every lover try entitled to $150,000 of that. It appears fair, but bringing you to $150,000 during the money is hard. You may have two not-so-higher alternatives:

You could sell the home: However your beat throughout the 10% of one’s house’s entire well worth in order to representative income or other charges. Up coming, you and your ex-partner must get once more, incurring higher financial costs and closing charge.

In the event the these options are from the dining table, it is time to turn-to a good HELOC. With an effective HELOC, you can tap into up to 100% of your house’s current worthy of. This is how.

When you get an effective HELOC to own a divorce payment?

You open a unique HELOC to own fifty% of the collateral ($150,000) right away in accordance with partners settlement costs. In just days, you could have the cash into payout.

New HELOC is positioned near the top of your existing first-mortgage. This no bank account loans Lakeside CO is exactly why talking about also referred to as next mortgage loans. The first home loan does not improvement in any way.

Let’s say I don’t have a number of equity in the home?

Thus, imagine if you have got a great $three hundred,000 house with an excellent $250,000 mortgage involved. That’s $50,000 when you look at the security and also the court states your spouse try titled so you can $twenty-five,000.

Who does bring your total of the many loans doing $275,000, or ninety five% loan-to-really worth. This is when the brand new HELOC extremely stands out. Zero financial gives you an earnings-out re-finance up to ninety five% LTV. But many HELOC lenders tend to.

Very even though you don’t have a lot of collateral yourself, there can be a good chance an effective HELOC can help with this new breakup payment payment.

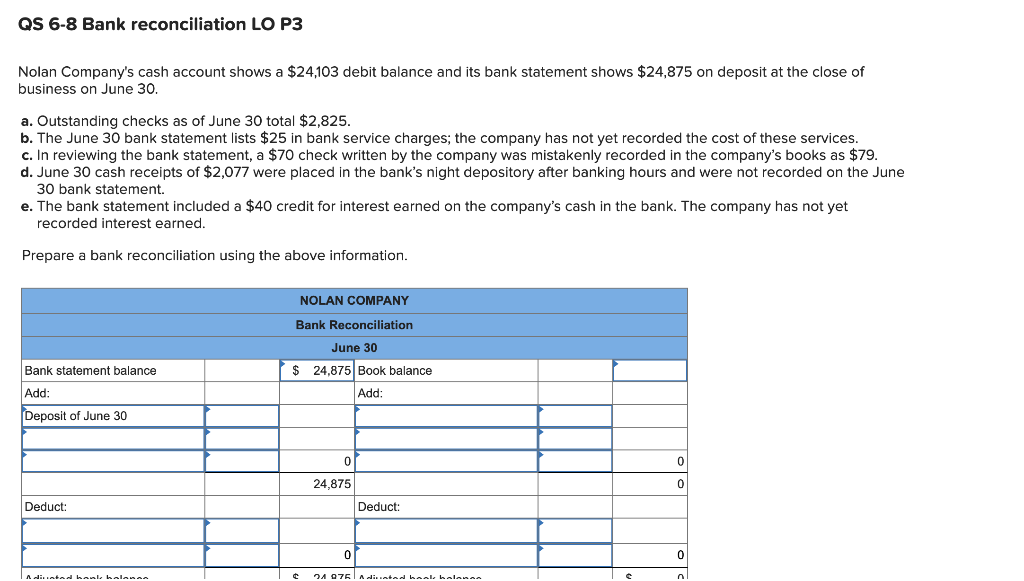

Analogy security and you may commission factors

Here are samples of the HELOC method can take advantage of away. It assumes good 50% split up out of home collateral, but your court ruling may be additional.

*Cost is actually such as for instance purposes merely and will not be offered. Apply for your house guarantee financing for your eligibility and rate.

*Cost is actually for example intentions simply and can even not be available. Submit an application for your house equity financing for your qualification and you will rate.

Thought a house security loan rather than a good HELOC

These loans is actually varying and you can based on the prime price. At the time of which creating, the top price was 8.25%. Perfect price moves up with new Federal Set-aside raises its key interest rate.

Currently, the latest Fed is found on good warpath to combat rising cost of living. Though it has actually backed off the aggressive price-hiking measures, they however can get walk costs by 0.25% or higher along the coming days. Thus a beneficial HELOC with a speeds of perfect + 0.25% will be 8.5% now but could end up being 8.75-9% from the year’s end.

Its for example property collateral line, nevertheless a fixed sum and you may comes with a predetermined speed. You can easily spend a higher rate with the fixed financing, but it eliminates the possibility of a good skyrocketing HELOC speed.

But never abandon the very thought of a HELOC. Most loan providers allow you to secure a portion or all of the of one’s HELOC shortly after closing. Consult your bank or credit connection on their guidelines throughout the a blog post-closing lock.

How-to be aware of the value of the home

In the process of getting the HELOC, query the lender once they would the full assessment. Once they manage, there was most likely an estimated $500 fee for this. If you are that is a downside, luckily for us which you are able to has an authorized elite group opinion of the home worth.

Sometimes, though, the fresh HELOC bank won’t acquisition an assessment. They are going to have fun with an enthusiastic AVM automatic valuation design. These are not necessarily specific.

We never ever purchase an assessment until he’s getting financing and it’s really required by the financial institution. You could order your very own appraisal. Simply do a quick Search getting a keen appraiser on your urban area.

Pros and cons out-of an effective HELOC to have separation and divorce

- Wake up so you can a great 100% joint loan-to-value

- End agent profits and you can fees that come with attempting to sell the home

- Don’t need to purchase once more in the highest pricing

- Stop shedding your current reasonable number 1 financial rates

- You might be capable protected a performance immediately after closing

- A good HELOC does not take away the wife or husband’s name on first home loan.

- You are going to need to qualify for the first and you can next mortgage payments whenever making an application for the latest HELOC

- HELOCs feature varying prices that are ascending

Separation and divorce payout HELOC FAQ

HELOC costs is greater than no. 1 financial cost. He’s in line with the finest rates, that’ll go up anytime centered on Provided movements.

Of a lot loan providers will let you protected the otherwise element of their HELOC balance shortly after closure. You can also get property collateral mortgage, which comes having a predetermined rates.

Of numerous loan providers will let you availableness around 100% of your residence’s security. Anytime you reside value $3 hundred,000 along with a beneficial $250,000 loan, you might be entitled to a good HELOC regarding $50,000 for many who qualify for the newest payments and you can meet other conditions.

Find out if a beneficial HELOC getting a divorce proceedings commission is great to possess your

The indicates will be based upon experience with the borrowed funds community and you can our company is seriously interested in working for you reach your aim of buying property. We may located settlement out of lover finance companies after you look at home loan costs listed on our website.