Due to the usually cyclic character off an excellent 1099 contractor’s functions, its income balance could pose a challenge in the getting a house financing. Although its money each package may be tall, lenders look for a long time out-of consistent employment. Very, mortgage officials should understand the way the duration of its customer’s work will work for otherwise up against all of them on mortgage procedure.

By firmly taking inventory of your dips and highs within the earnings, MLOs will find an average money over a specific ages of for you personally to determine if the fresh new borrower should be able to spend the borrowed funds.

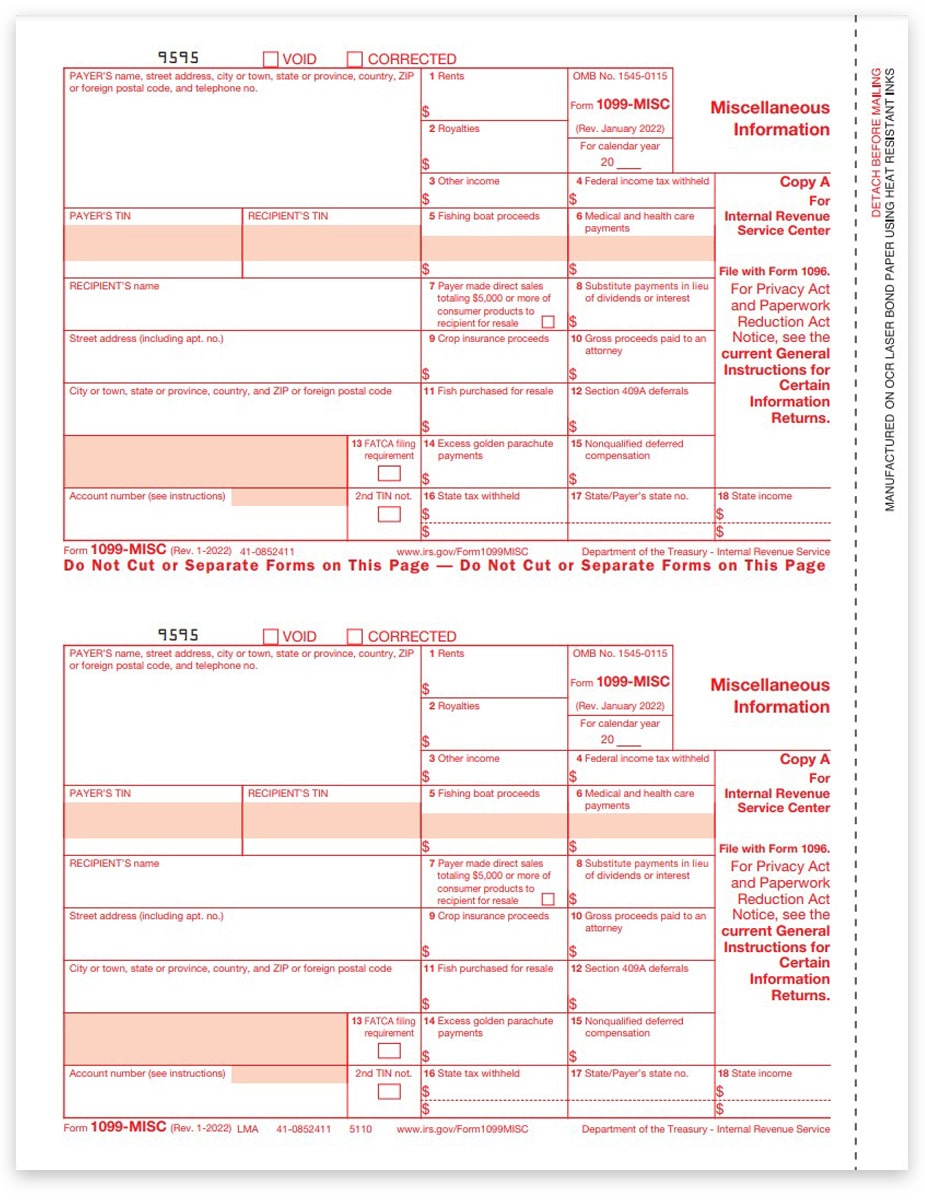

Income tax and you can recordkeeping.

Income tax and you may recordkeeping should be a different sort of difficulty getting 1099 builders. Besides manage they should maintain their particular income tax obligations, it is also hard to monitor what they are obligated to pay, exactly what they’ve got paid, or other expenses.

Real estate loan officers is to first acclimate themselves on various income tax affairs you to definitely worry about-working borrowers aren’t deal with. As well as miscellaneous taxation variations, MLOs must have a great understanding of finances/loss statements, tax returns, and you will bank comments. Which have an excellent grasp of one’s nuances of various tax products their self-employed readers deal with may help them dictate borrower eligibility.

Recordkeeping can be one of the most crucial products within the loan acceptance to possess builders. Not only will which have organized income tax suggestions demonstrate the new uniform earnings load one to loan providers require, it does carry out a feeling of openness and depend on when you look at the lenders. As the loan officials, are hands-on and providing the consumer to know the importance of patient recordkeeping and reporting will go a considerable ways towards an effective effective app.

Credit score and you may rating.

Creditworthiness is a very common importance of consumers; to own 1099 contractors, this criterion includes its demands. Quite often, self-working benefits can get a lot more personal lines of credit to help defense business expenses. With respect to the version of organization (e.grams., best proprietorship versus. LLC), men and women personal lines of credit will be in their own personal term. It indicates they may has actually high credit use and extra outstanding debts which could apply to their DTI ratio.

To address this challenge, first pull the mark borrower’s credit history and look for one points which can negatively affect its credit rating. A talented loan officer will be able to identify portion to possess improvement in accordance to your lender’s dependence on creditworthiness. And also this gives you the chance to inform customers into just what should be removed right up, standard facts about payment record, and how to fix any unpaid points.

Financing officers will help their clients improve their credit rating by offering borrowing from the bank-improving methods, borrowing training, and uniform realize-right up. Such as for instance, show clients about credit account diversity. Borrowing from the bank diversity makes up about doing ten% regarding someone’s credit score. Whilst it may possibly not be the largest reason for acquiring a beneficial mortgage, it will easily improve customer’s credit rating. Good 1099 contractors need a healthy equilibrium out-of revolving borrowing (e.g., handmade cards), installment money (age.g., providers otherwise vehicles), and you may discover borrowing (e.grams., bills).

Another way to help your clients with borrowing blemishes is by it comes them to credible borrowing from the bank counseling enterprises which will help during the boosting their score. These types of businesses might help potential consumers with handling loans and you will mode up a monthly funds.

To own best possible solution, you ought to help display screen the payday loan Trinity consumer’s advances in their borrowing upgrade travel. It is vital to remember that boosting credit needs time to work. Definitely promote the necessity for persistence and you will diligence in order to your web visitors.

Secret takeaways

Financing officials deal with several demands whenever helping their 1099 contractor subscribers that have obtaining a mortgage. Anywhere between money balance, credit concerns, and you may income tax, the journey in order to approval could be more strict than candidates with traditional W-dos work. Although not, homeownership is really as very theraputic for 1099 designers as it’s for other areas from professionals, that can provide such professionals even more financial advantages instance the capability to reduce the tax burdens inherent during the self-a job.