What you need to Know

- Yes! You can buy property no credit rating, but you will need to establish their creditworthiness in other ways

- In the place of old-fashioned credit, you’ll need to tell you a track record of towards-day money for the expenses for example book, resources or tuition

- A federal government-backed mortgage are going to be recommended with no-borrowing homebuyers having all the way down revenues

Articles

Maybe you have become renting and you’re sooo over it. Or you’ve been residing in the childhood bedroom and you can feel like you have outgrown your band posters and secondary school trophies. Or you have decided that it is time and energy to purchase their tough-gained cash in something that increases inside the value. And you can, bonus: You get to real time inside your webpage funding!

It is going to grab a great deal more legwork, and also the process will in all probability take longer. It may also be pricier because you may end with a higher home loan rate of interest, increased month-to-month mortgage repayment or end using financial insurance rates.

Sure, you will find costs to buying property with no credit score, but it you can do and we’ll guide you exactly how.

Let us view exactly what borrowing was, just what it methods to do not have credit score as well as how you can obtain your perfect household without it.

What is Borrowing?

Borrowing from the bank ‘s the ability to borrow money and you can pay it back. Credit generally speaking makes reference to your credit report, that is a record of how you invest and you can borrow money.

Your credit score is actually a collection of data. Simple fact is that level of funds and you will playing cards you’ve taken out and you may one financial obligation you borrowed. It reports if you pay the loan bills promptly and you will if you have overlooked money.

Your credit score plays a giant part in figuring your credit get. Your credit rating is actually a beneficial three-digit number off 300 850 that helps lenders determine whether your qualify for financing, how much cash they will give both you and within exactly what interest rate.

Since your credit history are heavily centered on your credit report, without having a credit score, you’ll not has a credit rating.

Which have zero credit score is not necessarily the same task as the having bad credit. Not really romantic! Its such with a notebook which have empty, blank pages.

The pages is actually blank because you have not got one borrowing activity on your own title, such an auto loan, education loan or bank card account. Or even you’re never ever produced a 3rd party user into someone else’s bank card account.

The user Financial Cover Bureau (CFPB) makes reference to someone rather than a credit score as borrowing invisible. Depending on the CFPB, up to twenty-six million American adults is borrowing hidden. People who happen to be probably getting zero credit score become :

- Younger: More than 80% regarding 18- and you will 19-year-olds are borrowing undetectable compared to significantly less than 40% men and women inside their twenties.

- Older: Borrowing invisibility grows following period of sixty.

- Members of underserved communities: For the all the way down-income areas along side All of us, almost 31% out-of adults is borrowing undetectable.

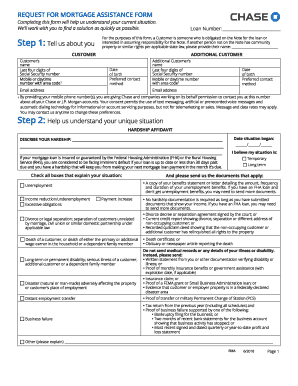

Providing a conventional Home loan With no Borrowing

Without a credit score or credit score helps it be harder to have lenders to check you since the a potential borrower but it’s maybe not impossible. Credit rating or perhaps not, lenders need certainly to evaluate and you can be sure your ability to repay an effective loan.

To take action, loan providers play with nontraditional credit analysis as opposed to antique borrowing data. In lieu of evaluating credit card(s) or financing payments, they remark the percentage records having such things as book, resources otherwise tuition. Lenders want to see if you consistently make your repayments towards the some time entirely.