You will find just one deal during my bank account repaid so you’re able to the fresh new name business reflecting the new cashier’s take a look at I provided them to shelter my personal deposit and you will closing costs. My plan was to classify most of the closing costs having fun with the latest custom created group “Home:House Pick:Settlement costs”, all of which might possibly be paid towards identity providers, and you may somehow have the advance payment become a transfer to sometimes the home account or even the home loan account to help you reflect the reality that that it is just a balance piece move from a funds house to property resource.

Basically import the brand new downpayment amount to the house membership, the worth of our home expands beyond its genuine really worth by the the amount of the brand new down-payment, which makes sense but is incorrect. Easily add more try this out the original mortgage because of the quantity of the advance payment immediately after which transfer new deposit count into the home loan account due to the fact earliest purchase, the fresh doing mortgage balance is correct nevertheless the payment per month try wrong.

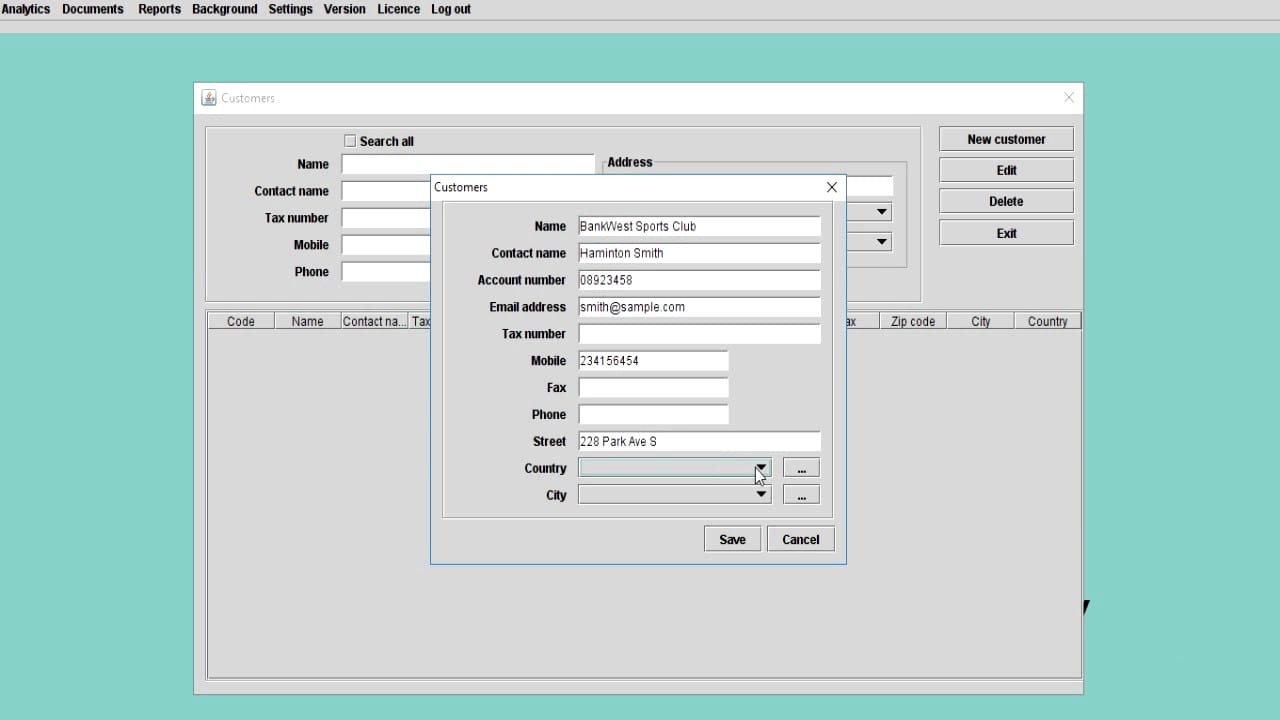

I’ve a beneficial “House” account options for recording this new home’s well worth, and financing (specifically financial) account settings to possess tracking the borrowed funds

What is the proper solution to design it? Just what category do i need to assign to your deposit portion of the transaction into term team representing the cashier’s check I gave them? It seems strange to go away they uncategorized as the overall online worth works out becoming correct that method.

I did select that it almost every other bond asking a similar concern not you to definitely poster’s first rung on the ladder appeared well enough distinct from exploit which i got issues pursuing the solution:

Responses

- The hole balance must have a comparable time since closing date and you can would-be throughout the number of $0.00 given that since the family is obtainable you haven’t but really closed to your home so to you personally they still has zero really worth.

- The fresh new $87.5K downpayment transaction on your family savings are an excellent move into our house membership.

- The level of the mortgage can be into the full amount of one’s mortgage ($262.5K amount owed into the family get + the fresh settlement costs). This might be their home loan starting harmony.

- From the mortgage check in, edit the opening equilibrium purchase adjust the category so you can an effective split up class.

- In the first line of the fresh split up category, go into a transfer from $262.5K for the home membership.

- On the second collection of the newest split class, go into your “Home:Home Pick:Settlement costs” class and you may go into the settlement costs count.

- As you are not entering more transactions are just changing the fresh category of the hole Equilibrium so you’re able to a split classification this can have no influence on the newest amortization and costs schedule.

features shown the fresh ‘right’ answer i do believe. I shall merely include this are we would like to to help you break down this new closing costs in more detail. You will need some will cost you to visit groups eg escrow to possess insurance policies, escrow getting fees, initially interest with the mortgage (as much as the first payment).

It is quite an excellent ‘your choice’ on what you would the worth of the property (the house house). Particular require you to to help you mirror pricing basis, some market value, particular possessions income tax worth. I’ve observed specific profiles who jobs which have several accounts – you to definitely into earliest (cost) value, and a second towards ‘gain’ (or losings?) over and above that cost basis. The choosing market price that is okay. Just be sure to provide sufficient defined as to what you should be able to get from the research.