Do you wish to loans your child’s college degree otherwise possess a giant home improvement investment coming up? Speaking of tall opportunities that require astounding capital upfront. If you are like any People in the us, your most effective resource can be your household. For those who have lived in your residence for decades and get collected a good amount of guarantee, property collateral mortgage from Huntington Bank is a superb option to simply help finance this type of opportunities. Property equity mortgage regarding Huntington Financial is a fantastic solution since it has no software charges, easy on the internet account administration, and you will fixed monthly payments owed at the time of your preference. Together with such bells and whistles, Huntington’s competitive prices make Huntington Bank a straightforward option for someone searching for property collateral financing.

Household Equity Mortgage Provides and Experts:

Property security financing away from Huntington Financial has the benefit of several has actually and experts. These characteristics and you may pros make it easier to take control of your domestic security mortgage and provide you with exceptional provider.

Versatile Commission Selection: Make repaired monthly premiums on 24 hours that fits your circumstances most readily useful. Which independency is very important to help take control of your month-to-month funds while the not every person gets paid off initially or avoid of day. Maybe you receive money mid times and/or 3rd times away from the fresh day, that it liberty makes you complement new commission with the plan.

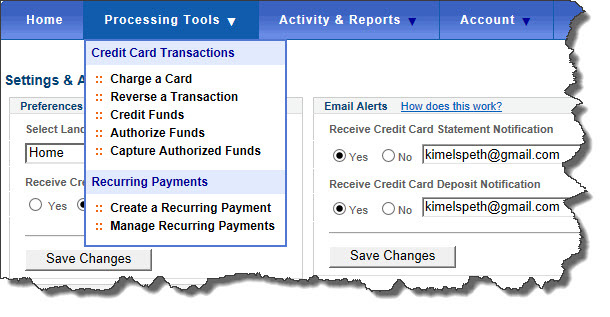

On line Account Management: On the web membership accessibility allows you to save time, evaluate your loan equilibrium, display deal records, and then make payments with 100 % free bill pay. Exactly what a handy means to fix take control of your account with a feeling regarding a fist americash loans Hudson.

Reduce your Monthly bills: When you yourself have highest personal credit card debt otherwise student loan, a home equity financing is an excellent solution to consolidate your own other debts and you may replace them with a home collateral loan. Constantly, the rate away from a house security mortgage is significantly straight down than versus interest rate of mastercard or education loan. You are indeed saving money and you will paying your debt in the course of time that have a house collateral loan.

Aggressive Pricing: The attention costs of Huntington Lender are aggressive and provide excellent value. When you protected a predetermined rates, it does not alter on the life of the borrowed funds.

Even more Huntington Lender Have:

Of course, Huntington has many great features which might be important for everyone their users. Huntington has arrived to provide the protection you would like and make your lifetime simpler. You could install new Huntington Mobile application thru Ios or Android os, for simple to view service constantly. Evaluate balances, pay the bills, review your account, whether you’re in the home otherwise away from home. Decrease chance and you can protect everything keep beloved having Huntington Industrial Providers Protection Government.

Know different types of payment procedures your potential customers can choose from which have Huntington Lender Small business Receivables Government. Huntington will get alternatives one to maximize your company, letting it grow and you will develop. Certain well known keeps was Huntington’s Asking solution, Lockbox services, Vendor solution, container deposit service, plus!

We are from inside the admiration at just just how many services Huntington now offers. Listed below are some Huntington Financial Worker Relocation Properties if you want to reduce the challenge regarding relocation. Prominent provides tend to be Head Bill which allow get better money having employee’s closure cost, Versatile Individual Home loan Insurance rates one slashed PMI right down to 10% from typical 20%, and you can Recast possibilities adjust monthly premiums according to mortgage matter.

Summation

A home security mortgage from Huntington Lender is an excellent solution when you yourself have gathered a number of guarantee on the house and require financial support to fund the second expenditures. Using its competitive rates and you will features, Huntington Financial is the ideal selection for some one in search of an effective domestic equity financing. Listed below are some all of our Huntington Bank Campaigns!

You’ll earn: 5x towards travel bought courtesy Chase Travelling SM 3x towards dining, discover streaming properties an internet-based groceries 2x with the some other take a trip purchases 1x towards the any other requests $50 Annual Chase Traveling Lodge Borrowing Rating no-cost accessibility DashPass which unlocks $0 delivery charge and lower service fees for a minimum of one year once you trigger by the .